The AMP Financial Wellness Report 2024 highlights the critical role advice can play in helping Aussies manage financial stress.

When it comes to financial advice, there’s a common misconception out there. People tend to think it’s all about numbers.

How much extra can you tip into super. What return your investments are making. How much you’re going to have in retirement.

And sure, the dollar amounts are important. But financial advice is about so much more than numbers on a spreadsheet. An adviser is a counsellor...someone to confide in and collaborate with to achieve your life goals.

So as part of the AMP Financial Wellness Report 2024 we went out and asked Australians what part advice is playing in their overall financial wellbeing.

Untapped potential

First things first. How many Australians are benefiting from advice?

The report shows 11% of Australians have engaged an adviser over the past 12 months. This means almost 9 out of 10 Aussies aren’t getting professional help from a financial adviser with their finances and are at the mercy of bogus advice from other sources – both online and offline. Mates down the pub. Random tweeters. Dr Google.

More than one in four (27%) people say they have been exposed to financial misinformation – and worryingly, 31% have acted on the incorrect information.

And the top sources of financial misinformation? Yes, not surprisingly it’s social media (37%) and online searches (20%).

The top 5 barriers to seeking advice

So why aren’t Aussies seeking advice? Here are the top five factors putting people off.

1. 46% feel the cost was too high.

2. 34% think their finances are simple enough to manage themselves.

3. 33% prefer making their own financial decisions.

4. 24% see themselves as able to make financial decisions without advice.

5. And 20% simply don’t trust others to look after their finances.

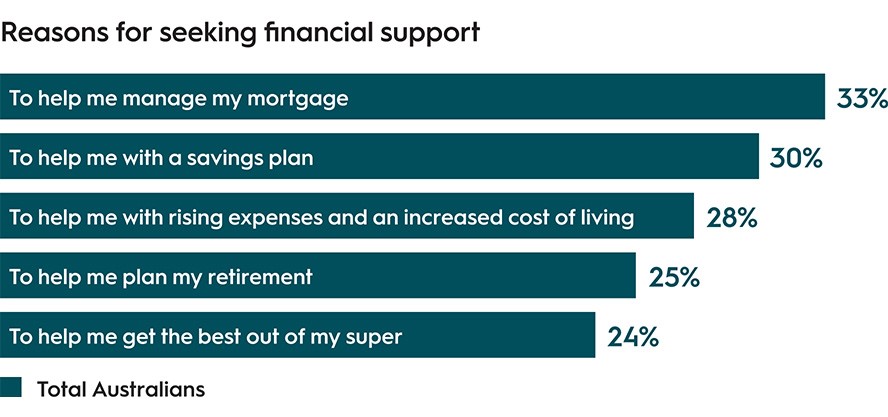

Research shows Aussies in 2024 tend to be a little more focused more on day-to-day issues than planning for the future – home loan repayments, savings plan and cost of living challenges are rating higher than retirement planning and super strategies. This reflects a very real gap – that many people are missing out on planning for the long term, including their retirement.

One challenge is the trust gap among Australians when it comes to financial advisers - those who have engaged with an adviser are more likely to trust them than those who haven’t.

So how are advisers helping their clients…and what are Aussies not getting advice missing out on?

3 ways advisers are helping Aussies feel better

1. Helping to set and achieve goals

It’s one of the most fundamental roles an adviser plays…setting clear, well-defined and achievable goals. And advisers are hitting it out of the park. The research shows Australians who have used an adviser feel a lot more organised. More of them have set clear financial goals and fewer of them haven’t got around to it, compared with Australians who aren’t getting advice.

21% of Aussies who have used a financial adviser say they have many clear, well-defined financial goals, compared to 8% of Australians who have not used a financial adviser.

2. Helping to ease stress…

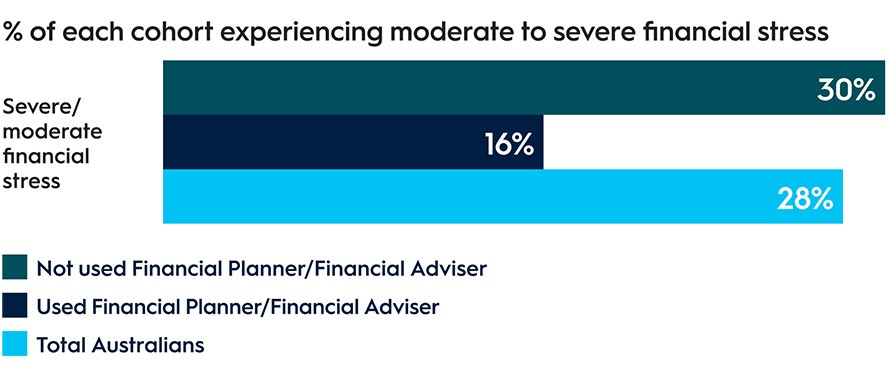

Advisers are clearly helping people manage their stress levels more effectively. Only 16% of advised Australians feel severely or moderately stressed, compared with 30% of those who have not used a financial adviser.

…and manage daily stress levels

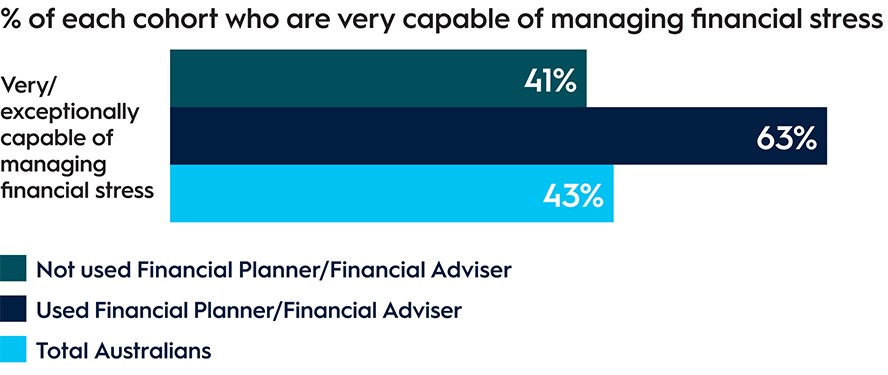

And almost two-thirds (64%) of people getting advice feel capable of managing daily financial stress well, compared with less than half (43%) of those who have never engaged with a financial adviser.

3. And helping to improve overall financial wellbeing

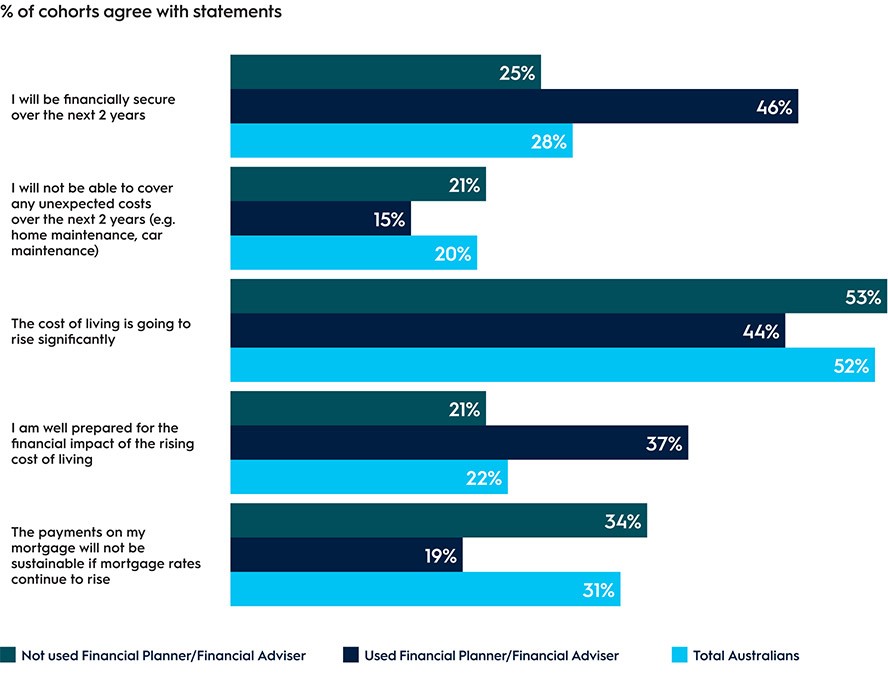

From mortgage repayments to living costs, financial security and emergency planning, the research is unambiguous. Advised Australians feel significantly more positive about money matters and capable of handling any financial curveballs that might be thrown at them.

Improving mental wealth

The research measured seven key pillars of mental wealth – mental wellbeing, happiness, financial stress management and resilience, work/life balance, personal growth, community support and psychological richness.

And there’s a clear link between financial stress and overall mental wellbeing – 48% of Australians rate their overall mental wellbeing as good but only 22% of Aussies who are moderately or severely financially stressed say the same. And half of us are happy with our lives overall, but that jumps to more than three in four (76%) of financially secure Australians.

So by helping Aussies get to grips with their finances, advisers can play a vital role in improving the nation’s overall financial wellbeing.

Getting advice a little earlier in life

The number one area people are searching for help with is super and retirement planning1. And the typical age of an advised client is 58 years old.

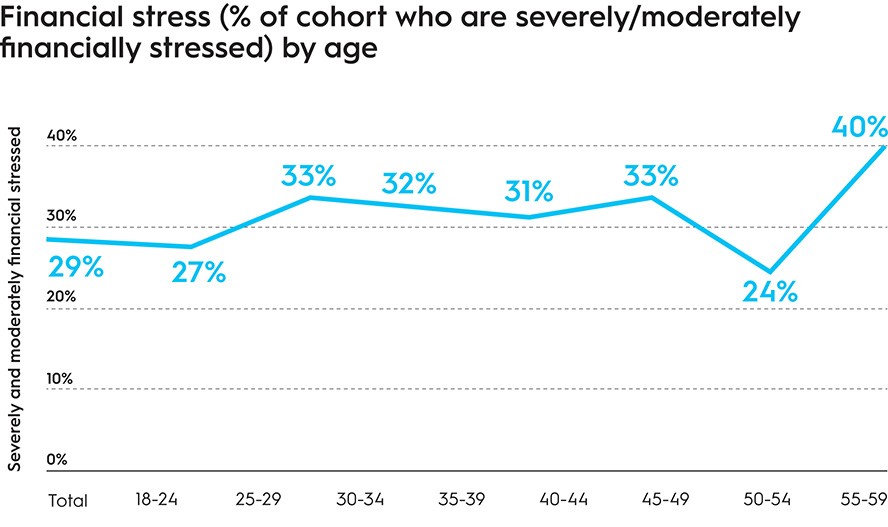

But as you can see in the graph below, this is right when many people are at peak stress levels – almost 40% of Australians aged between 55-59 are severely or moderately financially stressed.

A few years earlier it’s a different story – fewer than one in four Aussies between 50-54 are stressed.

So there’s a clear opportunity for advisers to engage their clients a little earlier in life when they’re less stressed.

It makes sense if you think about it. As their responsibilities start to fall away with the kids leaving home, people are still accumulating wealth. So it’s an ideal time to advise on pre-retirement planning at a time clients are more able to afford it.

Changing the retirement conversation

Retirement should be a time when your clients’ financial stresses melt away, leaving them free to pursue their passions and the joys of life. But too many retirees are worried their money will run out.

MyNorth Lifetime is an award-winning retirement solution only available on North that can help deliver an income to your clients that never runs out.

Important information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your client’s personal objectives, financial situation or needs, and a client should consider whether this information is appropriate for them before making any decisions. It’s important your client consider their circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

MyNorth Investment and North Investment are operated by NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFSL 234652 (NMFM). MyNorth Super and Pension (including MyNorth Lifetime), MyNorth Super and Pension Guarantee and North Super and Pension are issued by N.M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654 (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. NMMT issues the interests in and is the responsible entity for MyNorth Managed Portfolios. All managed portfolios may not be available across all products on the North platform. All of the products above are referred to collectively as MyNorth Products. The information on this page is provided only for the use of advisers, it is not intended for clients. This page provides a brief overview of some of the benefits of investing in MyNorth Products. The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N.M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N.M. Super) and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.

This article has been provided by NMMT Limited ABN 42 058 835 573, AFSL No. 234653 (NMMT) for professional adviser use only. The comments expressed represent the personal views and opinions of the adviser. MyNorth Lifetime is a part of MyNorth Super and Pension which is issued by N. M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654) (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. It’s important a person considers their circumstances and reads the relevant product disclosure statement and/or investor directed portfolio services guide and target market determination, available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

1 Adviser Ratings, Australian Financial Research Landscape 2024