Introducing the MyNorth Lifetime Income account

One of an award-winning2 suite of three solutions that financial advisers can use to help clients retire comfortably, confident they’ll have a lifetime of retirement income.

A MyNorth Lifetime Income account combines the flexibility of an account-based pension that provides a high-rate market-linked income stream with the certainty of a lifetime cashflow that never runs out, like an annuity.

The Lifetime Income account is a market-first retirement income solution that puts you in control of important portfolio decisions like investment strategy, asset allocation and security selection.

How the MyNorth Lifetime Income account works

We don’t know exactly how long any one of us will live, but we do know that Australian retirees are not spending their retirement savings. So, we’ve designed a solution that insures against the risk of anyone running out of money before they die.

The Lifetime Income account works a bit like life insurance in reverse.

Instead of paying annual premiums that rise each year in exchange for a lump sum paid to the estate after death, clients receive an annual bonus that rises the longer they live. In return, the premium is paid from their account when they die or exit the platform.

This gives your clients the confidence to draw higher rates of income than are generally drawn from an account-based pension.

And the Lifetime Income account puts you squarely in the driver’s seat as their adviser. You design, monitor and develop their solution over time to maintain a cashflow that lasts a lifetime.

Become a MyNorth Lifetime Master

Case study

Martin and Priyanka retire at age 67 with a combined $900,000 in super.

They decide they want the certainty of receiving income for life, as well as the flexibility of being able to withdraw extra money if needed.

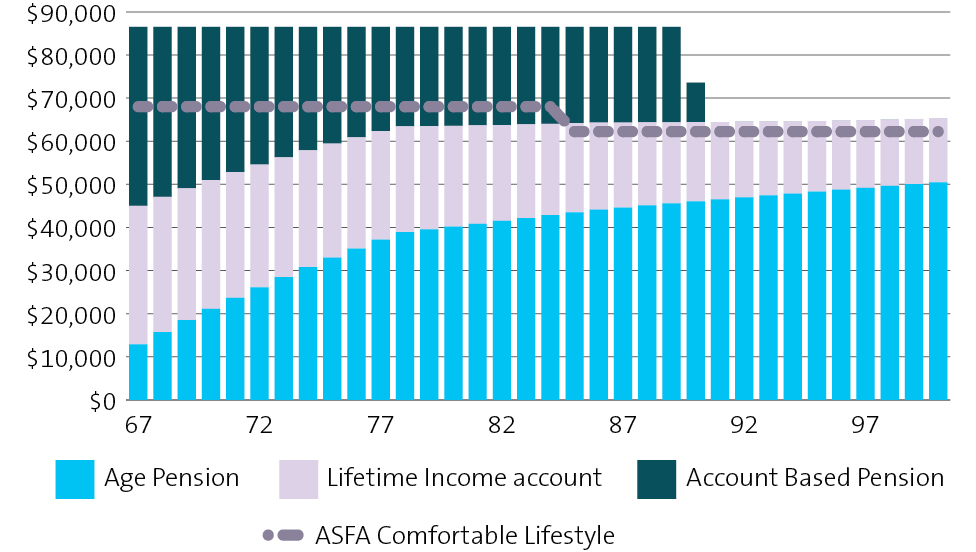

They transfer $450,000 to a Lifetime Income account, and $450,000 to an account-based pension.

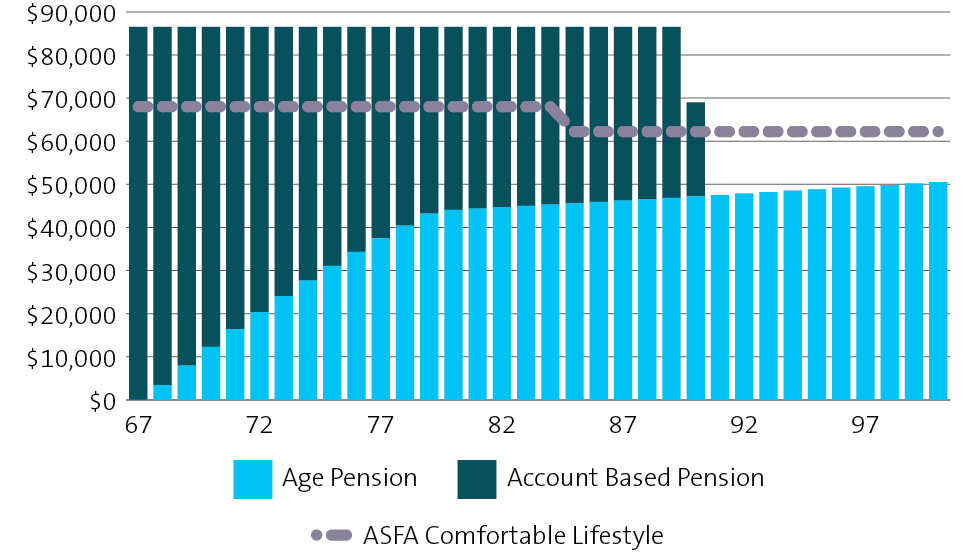

Martin and Priyanka set an income goal of $86,500 per annum. This results in their account-based pension being exhausted by the time they turn 90. This would have concerned Martin and Priyanka as the Australian lifetables5 indicate that 1 in 5 couples age 67 will have at least one surviving spouse who will make it to age 98.

However, the Lifetime Income account will continue to provide them with an ongoing income above the 2022 ASFA comfortable living standards.

If Martin and Priyanka had put all their money into an account-based pension, their account would have also run out at age 90 and they would have relied solely on the Age Pension for the remainder of their life.

Income

100% Account-based Pension

Martin and Priyanka’s Strategy

Assumptions

- All projections assume 2.3% CPI rate of inflation, 3% wage inflation (AWOTE), and 6% earnings pa

- All projections are in today’s dollars with income indexed to CPI

- 20 September 2022 age pension rates, deeming rates and thresholds applied (subject to inflation)

- ASFA figures are as of 20 September 2022 and are those for a couple

- Lifetime Account annually pays a $91 account fee + a 10bp lifetime fee

- Account Based Pension annually pays a $91 account fee

- Members are homeowners with $50,000 in other assets and $0 in other income during retirement

Learn about our other two solutions

MyNorth Lifetime Super account

A new type of accumulation account designed for clients up to 64 years and 10 months.

MyNorth Lifetime Deferred Income account

Maximise retirement benefits with greater flexibility and control, designed for clients aged between 60 - 89 who meet a condition of release.

Learn moreResources

We're here to help

North Service Centre

Monday to Friday

8.30am - 7pm (Sydney time)

Important information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your client’s personal objectives, financial situation or needs, and a client should consider whether this information is appropriate for them before making any decisions. It’s important your client consider their circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

MyNorth Investment and North Investment are operated by NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFSL 234652 (NMFM). MyNorth Super and Pension (including MyNorth Lifetime), MyNorth Super and Pension Guarantee and North Super and Pension are issued by N.M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654 (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. NMMT issues the interests in and is the responsible entity for MyNorth Managed Portfolios. All managed portfolios may not be available across all products on the North platform. All of the products above are referred to collectively as MyNorth Products. The information on this page is provided only for the use of advisers, it is not intended for clients. This page provides a brief overview of some of the benefits of investing in MyNorth Products. The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N.M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N.M. Super) and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.

1 Compared to typical account-based pension income rates

2 Deferred Lifetime Investment Linked Winner, and Innovation Winner, Plan for Life Excellence Awards, 2022, Pension Fund Design and Reform Award winner at World Pension Summit 2023, Chant West Best Fund: Innovation Winner 2023, Chant West Best Fund: Lifetime Product Winner 2024.

Zenith CW Pty Ltd ABN 20 639 121 403 AFSL 226872/AFS Rep No. 1280401 Chant West Awards issued 22 May 2024 are solely statements of opinion and not a recommendation in relation to making any investment decisions. Awards are current for 12 months and subject to change at any time. Awards for previous years are for historical purposes only. Full details on Chant West Awards at https://www.chantwest.com.au/fund-awards/about-the-awards.

3 In return your clients will leave some of their balance when they exit or die