Introducing the MyNorth Deferred Lifetime Income account

One of an award-winning1 suite of three solutions that financial advisers can use to help clients retire comfortably, confident they’ll have a lifetime of retirement income.

A MyNorth Deferred Lifetime Income account can be used in accumulation and may provide enhanced tax, transfer balance and Centrelink benefits; and provides greater opportunities for long-term client engagement with significantly better retirement outcomes2.

How the MyNorth Deferred Lifetime Income account works

A MyNorth Deferred Lifetime Income account can be opened from age 60, once a member meets a full condition of release. It’s the first pension account in Australia that accepts contributions.

You can set up the account using any investment options from North’s extensive Pension and Super menu. You can defer the income stream up to age 100 and along the way your client can access withdrawals up to the maximum commutation rate.

When your client is ready to commence an income, they can easily transition into a MyNorth Lifetime Income account.

Become a MyNorth Lifetime Master

Case study

Jinoo is 60 years of age, single, and recently left his old employer for a new full-time role.

Strategy

- $190,000 (50%) of his super into a Deferred Lifetime Income account

- $190,000 (50%) of his super remains in standard super

- Split contributions evenly between both accounts

- 70% growth investment profile, generating 5.31% pa net of investment earnings and platform administration fees

Goals

- Wants to retire age 70

- Wants regular income in retirement that will not run out, as well as money aside for discretionary spending

Situation

- Met a condition of release by ceasing his previous employment arrangement on or after the age of 60

- Earns $100,000 gross salary pa, indexed to wage inflation

- Has $380,000 in super and his employer contributes 12%

Jinoo’s pre-retirement

By the age of 70, Jinoo’s standard super balance has compounded annually by the investment earnings and contributions he has made and is worth $298,796, of which the full value will be assessed by Centrelink for the Age Pension asset test.

At this time, his Deferred Lifetime Income balance has also compounded annually by the same investment earnings and contributions and is worth $320,424; approximately $22,000 more than his standard super balance because he does not pay investment earnings tax and receives a guaranteed annual bonus each year in his Deferred Lifetime Income account.

Additionally, Deferred Lifetime Income accounts accrue a purchase amount equal to all contributions less commutations (not including investment earnings). A further 40% discount is applied to the purchase amount, which is then assessed by Centrelink for the age pension asset test. As such, only $118,758 (37% of his actual account balance) is assessable from Jinoo’s Deferred Lifetime Income account at age 70.

Jinoo’s retirement

Jinoo retires at age 70, is a homeowner with an additional $100,000 in other assets. He wants to receive $60,000 income in today’s dollar’s indexed to CPI. He rolls his Deferred Lifetime Income account into a Lifetime Income account and rolls his standard super into an Account Based Pension.

Assumptions

- All projections assume 2.3% CPI rate of inflation, and 3% wage inflation (AWOTE)

- All income, capital and age pension projections are in today’s dollar's indexed to CPI

- Investment Earnings Tax is 15% (of a standard super account)

- Concessional Contributions Tax is 15%

- All concessional contributions are within concessional cap

- 20 September 2022 age pension rates, deeming rates and thresholds applied (subject to inflation)

- Lifetime Account annually pays a $91 account fee + a 10bp lifetime fee

- Standard Super and Account Based Pensions annually pay a $91 account fee

- All investment earnings are assumed to be net of fees

Jinoo's retirement income

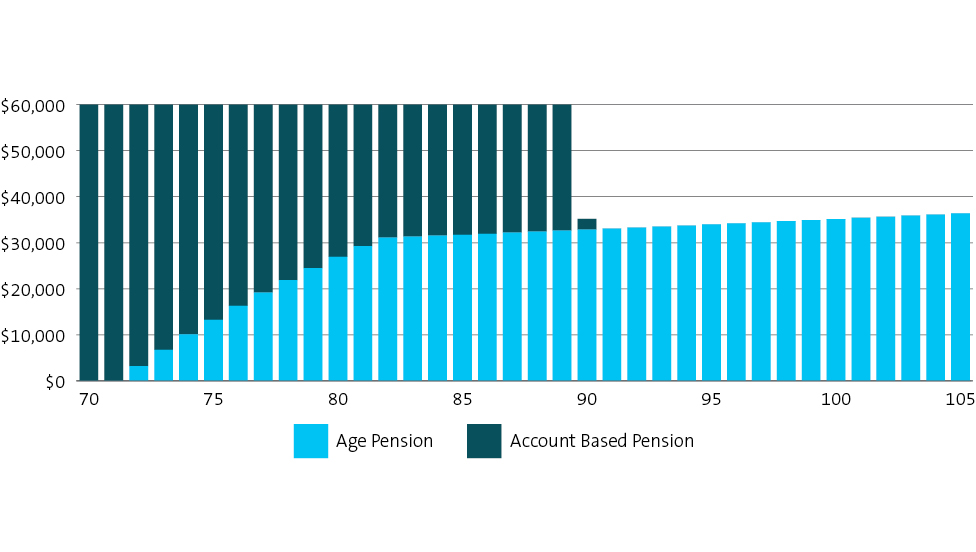

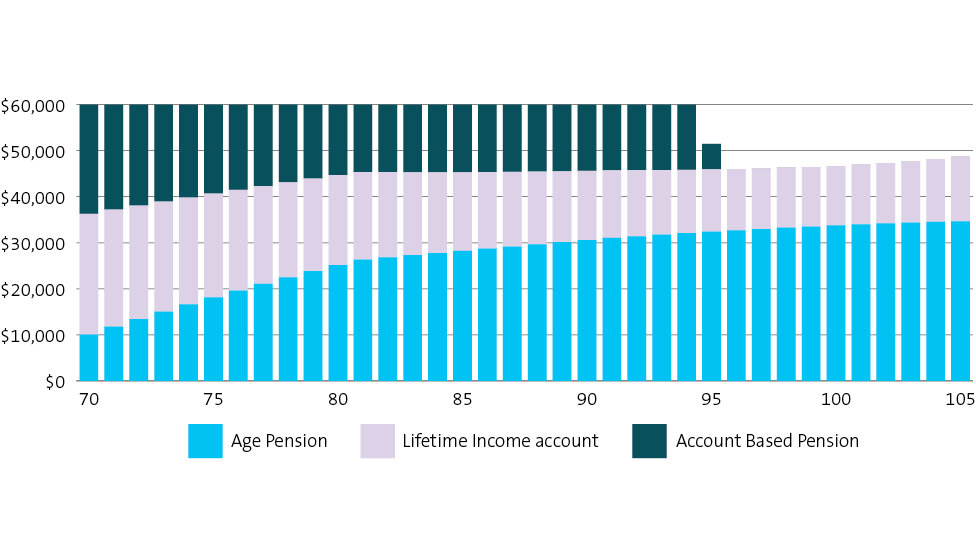

Because of Jinoo’s reduced Centrelink assets test, he immediately receives over $10,000 in Age Pension in his first year of retirement, where he would otherwise receive $0 in the absence of MyNorth Lifetime.

Jinoo is also able to sustain his $60,000 income goal for an additional 5 years due to the increased Age Pension and MyNorth Lifetime income he receives each year. When his Account Based Pension finally depletes at age 95, his MyNorth Lifetime Income account continues to pay income for the remainder of his life, preventing him from ever relying on the Age Pension alone.

100% Standard Super and Account Based Pension

Jinoo’s Strategy

Learn about our other two solutions

MyNorth Lifetime Super account

A new type of accumulation account designed for clients up to 64 years and 10 months.

Learn moreMyNorth Lifetime Income account

Provide your clients with a higher income for life2, designed for clients between the ages of 60 - 89.

Learn more

Resources

We're here to help

North Service Centre

Monday to Friday

8.30am - 7pm (Sydney time)

Important information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your client’s personal objectives, financial situation or needs, and a client should consider whether this information is appropriate for them before making any decisions. It’s important your client consider their circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

MyNorth Investment and North Investment are operated by NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFSL 234652 (NMFM). MyNorth Super and Pension (including MyNorth Lifetime), MyNorth Super and Pension Guarantee and North Super and Pension are issued by N.M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654 (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. NMMT issues the interests in and is the responsible entity for MyNorth Managed Portfolios. All managed portfolios may not be available across all products on the North platform. All of the products above are referred to collectively as MyNorth Products. The information on this page is provided only for the use of advisers, it is not intended for clients. This page provides a brief overview of some of the benefits of investing in MyNorth Products. The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N.M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N.M. Super) and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.

1 Deferred Lifetime Investment Linked Winner, and Innovation Winner, Plan for Life Excellence Awards, 2022, Pension Fund Design and Reform Award winner at World Pension Summit 2023, Chant West Best Fund: Innovation Winner 2023, Chant West Best Fund: Lifetime Product Winner 2024.

Zenith CW Pty Ltd ABN 20 639 121 403 AFSL 226872/AFS Rep No. 1280401 Chant West Awards issued 22 May 2024 are solely statements of opinion and not a recommendation in relation to making any investment decisions. Awards are current for 12 months and subject to change at any time. Awards for previous years are for historical purposes only. Full details on Chant West Awards at https://www.chantwest.com.au/fund-awards/about-the-awards.

2 Compared to typical account-based pension income rates