✓ 60-year-old female

✓ $600,000 in savings

✓ $50,000 annual retirement income goal

✓ MyNorth Deferred Lifetime Income account

✓ Account-based pension

✓ $9,954 received in annual bonuses

✓ $12,387 received in Age Pension

Nora is a 60-year-old single retiree with $600,000 in savings and aims for a $50,000 annual income in retirement. Her adviser suggests using both a MyNorth Deferred Lifetime Income account and an account-based pension to achieve her goal.

By transferring $300,000 into the MyNorth Deferred Lifetime Income account, Nora enjoys tax-free earnings, an annual bonus, and a 40% upfront discount on future age pension assessment. She is advised to take the maximum lump sum withdrawals to fund a portion of her income goal, which equally reduces her asset test value. The account also accepts contributions.

By moving the remaining $300,000 to an account-based pension, she additionally benefits from tax-free earnings and capital access. Nora withdraws income from her account-based pension to subsidise the remainder of her income goal.

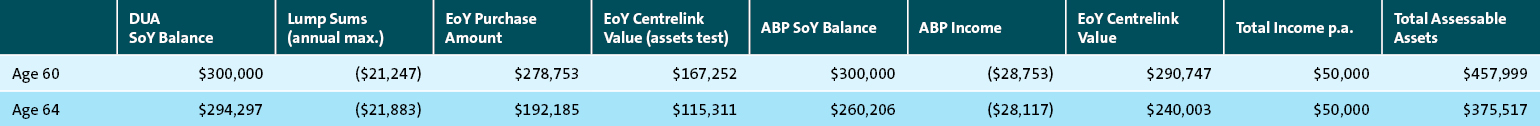

The table outlines Nora’s adviser’s recommendations.

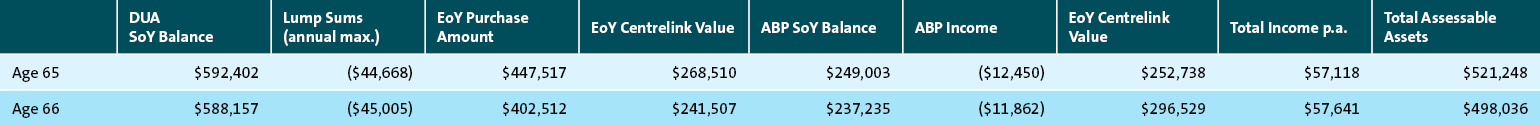

From age 60 to 64, Nora has been able to meet her $50,000 retirement income goal while reducing her total Centrelink assessable assets to $375,517. At age 65, Nora sells her home and makes an additional $300,000 downsizer contribution to her MyNorth Deferred Lifetime Income account. Here’s a summary of Nora’s retirement outcomes from age 65 to 67.

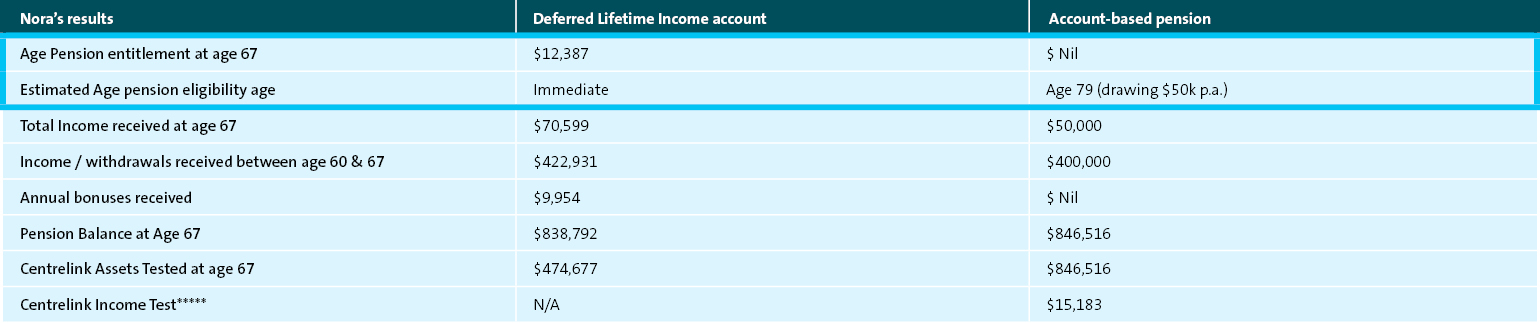

Due to her reduced MyNorth Deferred Lifetime Income asset test, Nora receives $12,387 pa in age pension entitlements at age 67, which contributes to her total income income of $70,559 including lump sum withdrawals and income payments. Had she instead utilised an account-based pension alone from age 60, her asset test would have exceeded the upper limit, and Nora would not have been eligible to receive age pension until the age of 79.

Here’s a summary of the value of the deferred strategy compared with a 100% account-based pension strategy.

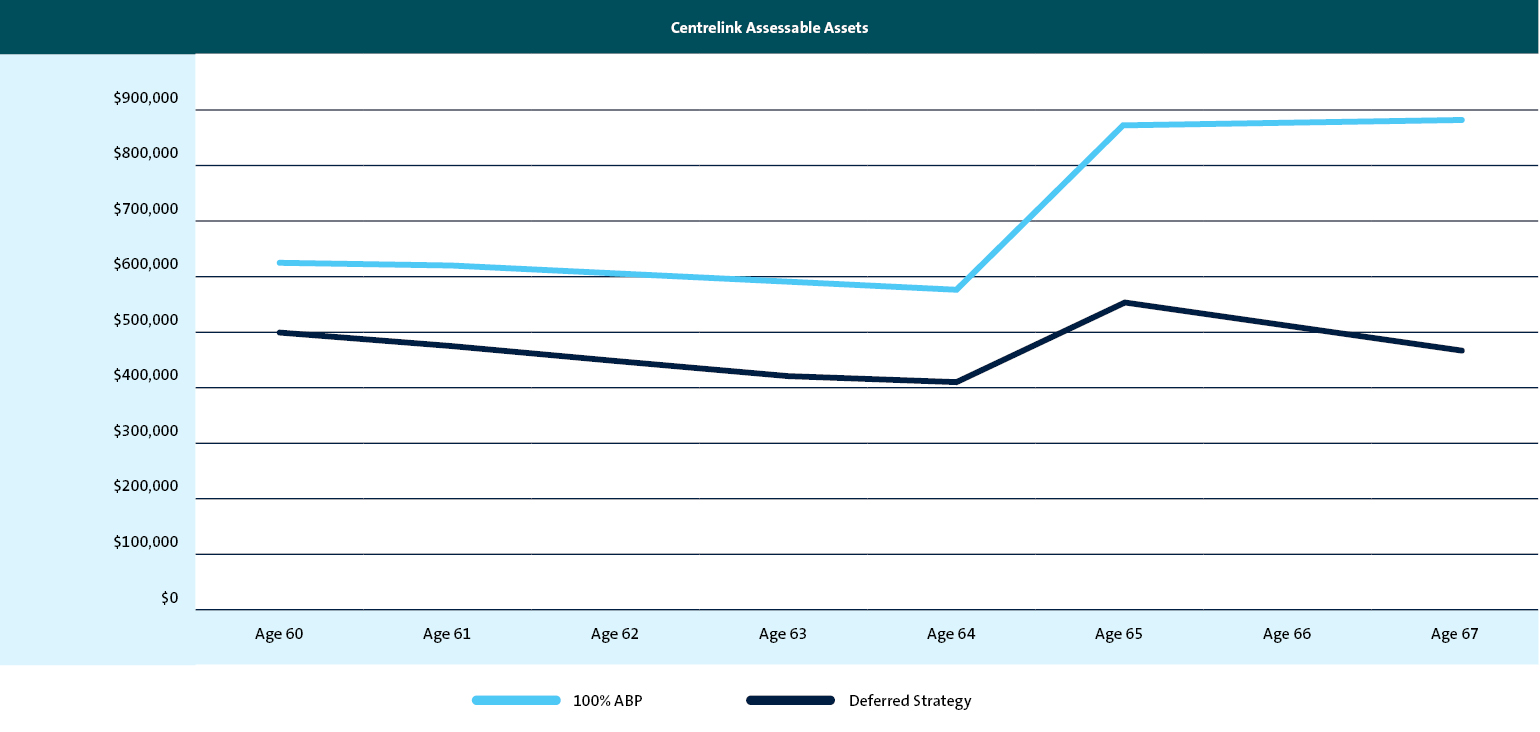

And here’s the estimated difference in the Centrelink assessable assets between the deferred strategy and a 100% account-based pension strategy from age 60-67.

Like to know more?

Our MyNorth Lifetime Master series of 10-minute videos offers a convenient way to become an expert in our award-winning* suite of retirement solutions.

Notes

** The Centrelink assets test value is 60 per cent of purchase amount to age 84 (or 5 year minimum), and 30 per cent thereafter

*** Contributions will increase the Centrelink purchase amount

**** Nora can elect to reduce her lump sums to zero till age 99 whilst in the Deferred Lifetime Income account

***** Lump sums are not assessed as income and deeming does not apply

- The Capital Access Schedule limits in the SIS Regs limit the total amount of voluntary lump sums permitted from the Deferred Lifetime Income account

- Nora’s Transfer Balance Cap is equal to her purchase amount

Assumptions

- Balanced RP = 6.5% across all account structures;

- We have ignored admin, investment and advisers fees;

- Ignored other Centrelink assessable assets and income;

- Deferred Lifetime income account as opted out of death and exit benefit to increase annual bonus;

- Age pension is based on July 2023 single homeowner thresholds and rate; and

- All values are nominal.

Master MyNorth Lifetime

Important information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your client’s personal objectives, financial situation or needs, and a client should consider whether this information is appropriate for them before making any decisions. It’s important your client consider their circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

MyNorth Investment and North Investment are operated by NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFSL 234652 (NMFM). MyNorth Super and Pension (including MyNorth Lifetime), MyNorth Super and Pension Guarantee and North Super and Pension are issued by N.M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654 (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. NMMT issues the interests in and is the responsible entity for MyNorth Managed Portfolios. All managed portfolios may not be available across all products on the North platform. All of the products above are referred to collectively as MyNorth Products. The information on this page is provided only for the use of advisers, it is not intended for clients. This page provides a brief overview of some of the benefits of investing in MyNorth Products. The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N.M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N.M. Super) and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.

1 Deferred Lifetime Investment Linked Winner, and Innovation Winner, Plan for Life Excellence Awards, 2022, Pension Fund Design and Reform Award winner at World Pension Summit 2023.