From 24 June there will be some minor updates to Annual, Exit and Transfer Exit Statements for Super and Pension accounts.

The changes relate to the ‘Fees and Costs deducted from your Investment' section of MyNorth and North periodic statements and some wording changes in the Additional Information section.

Why are the changes being made?

The North platform has set up a reserve account where the trustee may set aside assets of the Wealth Personal Superannuation and Pension Fund (Fund) which, subject to the governing rules of the Fund, may be used for any purpose that the trustee considers supports the management of the Fund or promotes the best financial interests of the members. For example, money held in the reserve may be used to pay for, or partially pay for, trustee expenses.

This may reduce the amount of trustee fees that are deducted from your client's account that are used to pay for these trustee expenses.

An approximation of certain administration-related fees and costs of the Fund paid from reserves that were not directly charged to your client's account are included in the ‘Fees and costs deducted from your investment' section of the statements.

What do the changes look like?

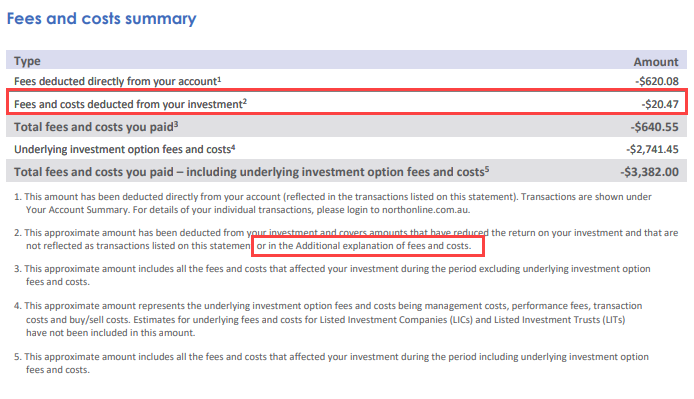

Annual, Exit and Transfer Exit Statements – Fees and Costs deducted from your investment (example: Annual Statement)

- The approximation of administration-related fees and costs of the Fund paid from reserves will be included in the dollar amount highlighted by the red box. Please note, this amount is an indirect cost and the value of your client's account has not changed as a result of the payment from the reserves

- There has also been a minor wording addition to footnote 2 (also signified in a red box).

Annual, Exit and Transfer Exit Statements – Additional Information wording updates

- Wording in bold in the screen shot below will be added the statements. This wording describes the administration-related fees in relation to the Fund reserves that are now included in the Fees and costs deducted from your investment” section of periodic statements and also detail what the Reserve is and what it’s used for.

| Heading | Wording |

| Fees and costs deducted from your investment | Fees and costs deducted from your investment comprise the following:

Annual Statement wording

Exit and Transfer Exit Statement wording

|

| Fees deducted directly from your account | The total amount of direct fees (administration, advice and insurance (premiums), as applicable) charged to your account for the reporting period less any rebates paid directly into your account. |

| Member level tax rebate | Tax deductions claimed by the fund that may be passed onto you in the form of a rebate. These may include imputation and foreign tax credits. |

| Reserves | The trustee may set aside in a reserve, assets of the fund which, subject to the governing rules of the fund, may be used for any purpose that the trustee considers supports the management of the fund or promotes the best financial interests of the members. For example, money held in the reserve may be used to pay for, or partially pay for, trustee expenses. This may reduce the amount of trustee fees that are deducted from your account that are used to pay for these trustee expenses. An approximation of certain administration-related fees and costs of the fund paid from reserves that were not directly charged to your account are included in the ‘Fees and costs deducted from your investment'. |

What do I need to do?

Nothing is required from you other than being aware of the changes.

More information

The following support materials are available to help you understand these changes:

If you have any questions about the changes, please speak to your Business Development Manager or the North Service Centre.

We’re providing more flexibility for you and your clients

03 July 2024 We continue to invest into our Managed Portfolio offer on North and we’re committed to providing more flexibility and choice for how you manage your clients’ assets. Read more

Support Staff get easier access to adviser data

03 July 2024 We're improving data access for support staff to better assist you and your clients. Read more

MyNorth Lifetime webinar series

20 June 2024 Brush up on your knowledge of our retirement solutions and tools or ask us the questions you’ve been mulling in these drop-in weekly webinars. Read moreImportant information

The information you provide is being collected by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT) in order to respond to your enquiry. If you don't provide the information requested, NMMT may not be able to respond to your query. Your personal information may be shared with business areas or companies within the AMP Group. We may also provide information to local and overseas entities which provide AMP with administrative, financial, research or other services, other insurers and credit providers, financial planners, brokers and other organisations authorised by AMP to assist in reviewing customer needs. We may also disclose personal information to courts, tribunals and dispute resolution bodies, government agencies, and other bodies we are required to provide information to under the law. A list of countries where these providers are likely to be located can be accessed via the AMP Privacy Policy.

The AMP Privacy Policy provides more information about how we manage and protect the personal information we hold about individuals. It sets out how you can access and correct the information that AMP holds about you, how you may complain about a breach of privacy and our process for resolving privacy related enquiries and complaints.