The portability benefits of managed portfolios can reduce tax frictions

Managing your client’s risk profile throughout their investment journey is one of the most important ways you can add value as their trusted adviser.

As you build up a long-term relationship, you’ll need to help them navigate life’s key milestones.

- They may need to increase their risk profile towards the start of their investment journey.

- They may need to play catch-up with a more risk seeking or active approach following a major life change such as separation or divorce.

- And they may need to derisk their investments as they approach retirement.

But whenever you adjust their portfolio, you’ll potentially need to sell down assets and reinvest, which may trigger a capital gains tax (CGT) event.

The solution could be a separately managed account (SMA).

Also known as managed portfolios or managed accounts, some SMA portfolio ranges are constructed using common underlying holdings. This means that when you need to adjust your client’s portfolio, you can transfer those common holdings across in specie, potentially incurring a lesser CGT liability in the process.

Here’s a practical example of how the in-specie transfer advantages of managed portfolios can help a client transition their portfolio towards retirement.

How it works | Serena and Sean’s story

Let’s look at two hypothetical clients – Serena and Sean.

- Both Serena and Sean have $156,000 in super at age 40.

- They both hold the same portfolio comprised of 85% Growth assets and 15% Defensive assets. Crucially, Serena uses an SMA while Sean is invested in a managed fund.

- Fast forward to age 62 and both Sean and Serena have amassed a Super balance of $714,378 in today’s dollars.

- They both switch into a Balanced risk option (70% Growth assets) as part of a de-risking strategy.

Serena incurs $7,353 in CGT because she only needs to sell down a small proportion of her holdings to create the new Balanced portfolio asset mix. This is because the Diversified Index Growth portfolio has an 84% overlap of underlying holdings with the Diversified Index Balanced portfolio, meaning only 16% of her holdings need to be sold down to make the transition. The other 84% is simply ported across in specie, potentially saving her significant sums in CGT.

Sean on the other hand, incurs $45,954 in CGT because he needs to sell down 100% of his holdings and reinvest the proceeds in a Balanced managed fund.

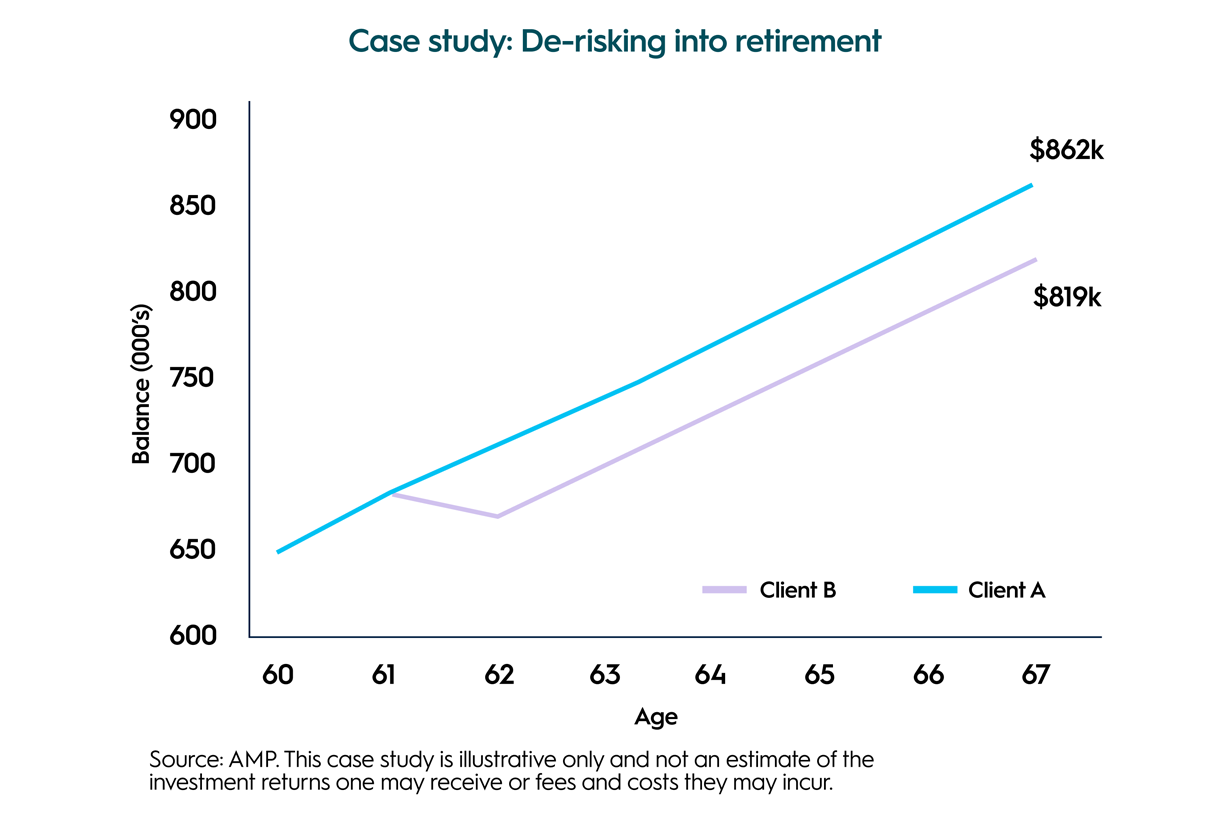

As you can see in the graph below, the impact of this tax gap is even more pronounced when they both elect to retire at age 67. At this point, Serena has amassed $862,000 in Super compared to $819,000 for Sean – a difference of 5.2%, due to Serena’s use of SMAs.

The scale of the in-specie transfer benefits for an SMA client will be contingent on how early a client begins their investment journey in SMAs, as opposed to products with less favourable tax treatments. It will also depend on their contributions and the returns generated by their portfolio holdings. All else being equal, however, the benefits conferred to the SMA investor can be substantial.

These benefits also stack up favourably compared with other forms of investment value-add, such as lower fees, franking credits and active management alpha.

So as can be seen here, utilising SMAs throughout the investment journey can potentially help you to manage inevitable changes to a client’s portfolio in a more tax-efficient manner. In doing so you could help maximise their investment outcomes.

Find out more

Check out the MyNorth Diversified suite of 22 multi-asset portfolios across 3 core portfolio ranges; spanning fully passive through fully active investment strategies, that can help provide wealth and tax efficiencies throughout your clients’ investment journey.

Sandstone Insights - March Best Ideas

11 March 2025 Sandstone Insights have updated their Best Ideas list with the latest recommendations for March. Read more

Retirement education with Kaplan Professional

03 March 2025 We have recently partnered with Kaplan Professional to deliver retirement education with Ben Hillier, Director, Retirement at AMP. Take a look at the available modules. Read more

MyNorth Lifetime webinar series

28 January 2025 Brush up on your knowledge of our retirement solutions and tools or ask us the questions you’ve been mulling in these drop-in weekly webinars. Read moreImportant information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT), in its capacity as responsible entity of, and issuer of interests in MyNorth Managed Portfolios (ARSN 624 544 136). It’s for professional adviser use only and must not be distributed to or made available to retail clients. This page provides a brief overview of some of the benefits of investing in certain diversified managed portfolios available through MyNorth Managed Portfolios.

It contains general advice, and does not take account of your client’s personal objectives, financial situation or needs and a client should consider whether this information is appropriate for them before making any decisions. It’s important your clients consider their circumstances and read the relevant product disclosure statement(s) (PDS), investor directed portfolio services guide (IDPS Guide) and target market determination(s) (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements. Past performance is no guarantee of future performance. Any case studies and examples are illustrative only and aren’t an estimate of the investment returns one may receive, or fees and costs one may incur. Any general tax information provided is intended as a guide only and is based on our general understanding of taxation laws current at the date of publication. It’s not intended to be a substitute for specialised taxation advice or an assessment of a client’s liabilities, obligations or entitlements that arise, or could arise, under taxation law. A client should consult with a registered tax agent / tax professional before deciding to act on the information provided.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.