It’s a common scenario - you’re preparing for a client review with a couple and want to share how they’re doing from an individual and a joint perspective.

And on North, it just got a whole lot easier. North’s innovative client review tool, North Interactive, introduced earlier in 2024, now enables consolidated reporting across multiple client accounts.

Super helpful for creating reporting for couples or family groups. And also for clients involved in multiple entities eg. A company, trust or SMSF.

You can get multiple clients and accounts as a combined aggregate, individually, or both views in the same report- the choice is yours.

It’s a new dawn for client reviews.

North Interactive has been described as the “best review tool in the market”* and is changing the client review game for practices across Australia.

Here are just four reasons to love North Interactive

1. Save time by consolidating across accounts and clients

“North Interactive has streamlined our workflow by compiling key information in a single, intuitive menu, reducing preparation and navigation time”

- Jesse Romeo, Financial Planner at Aspire Planning Group

Practices have been benefiting from the option to merge data across a group of accounts, show accounts individually, or a combination of both in a single report.

And now, they can save even more time and resources with consolidation across multiple clients.

2. Tell a personalised story in your preferred format

“I’m using the reports in meetings; in some cases, preparing with the client’s inputs/requests. I’m finding they like being able to tailor items like date ranges for performance reporting.”

- Malcolm Davis, Principal at Aspire2Wealth

With North Interactive you can customise the report content order to mirror the preferred flow of a client conversation, and then use digital presentation mode to bring your advice to life with stunning visuals. You can also add your own commentary and file notes.

Or you might instead choose to generate a PDF to email the client, or a Word doc output you can modify as required. Whatever suits you best.

3. Make it your own with your practice’s brand

You can add your own branding to both the digital presentation mode and exportable report presenting this as a bespoke resource of your practice.

Simply remove the North logo and add your practice’s.

4. Use stunning digital charts to convey the value of your advice

“The tool’s interface allows clients to grasp complex financial information at a glance, making review sessions more interactive and reinforcing our commitment to delivering a modern, client-focused experience.”

- Jesse Romeo, Financial Planner at Aspire Planning Group

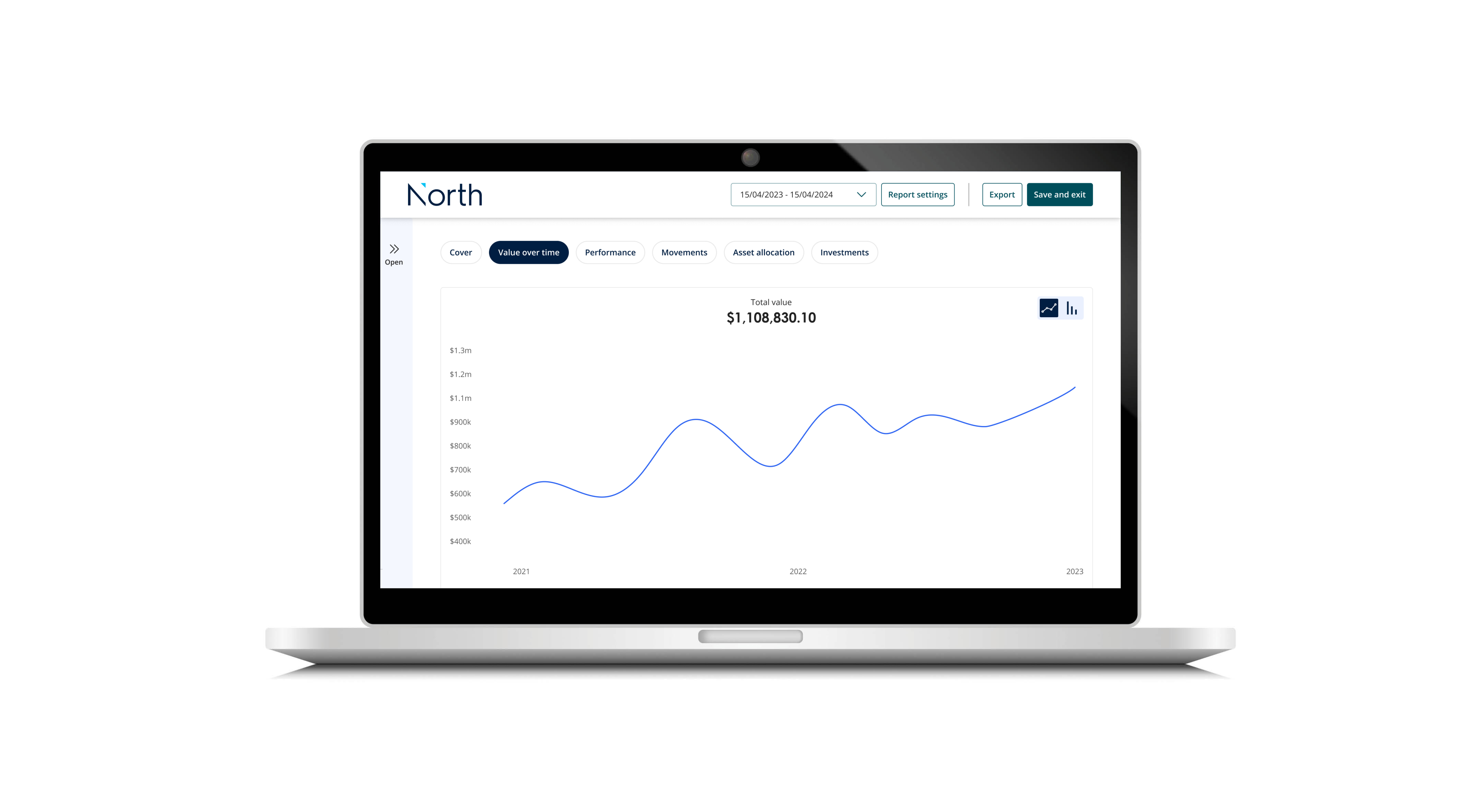

North Interactive’s charts allow you to represent value over time, show a summary of movements, demonstrate account and investment performance, and also compare asset allocation with client risk profiles.

Making it easier to quantify and communicate your impact.

… And there’s more to come.

We’re committed to taking your client reviews to the next level. Stay tuned for more exciting enhancements on the horizon.

For more information on how North Interactive could change the game for you, chat to your BDM or book a demo below.

Schedule a demo

Straight to the point, we love it!

Submit your details and a member of our team will be in contact to organise a demo of our platform.

* mandatory field

Federal Budget update 2025- North

26 March 2025 Read an update from our experts on last night's announcements and share insights with your clients. Read more

Sandstone Insights - March Best Ideas

11 March 2025 Sandstone Insights have updated their Best Ideas list with the latest recommendations for March. Read more

Retirement education with Kaplan Professional

03 March 2025 We have recently partnered with Kaplan Professional to deliver retirement education with Ben Hillier, Director, Retirement at AMP. Take a look at the available modules. Read more

Important information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your client’s personal objectives, financial situation or needs, and a client should consider whether this information is appropriate for them before making any decisions. It’s important your client consider their circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

MyNorth Investment and North Investment are operated by NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFSL 234652 (NMFM). MyNorth Super and Pension (including MyNorth Lifetime), MyNorth Super and Pension Guarantee and North Super and Pension are issued by N.M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654 (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. NMMT issues the interests in and is the responsible entity for MyNorth Managed Portfolios. All managed portfolios may not be available across all products on the North platform. All of the products above are referred to collectively as MyNorth Products. The information on this page is provided only for the use of advisers, it is not intended for clients. This page provides a brief overview of some of the benefits of investing in MyNorth Products. The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N.M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N.M. Super) and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.

This article has been provided by NMMT Limited ABN 42 058 835 573, AFSL No. 234653 (NMMT) for professional adviser use only and is general in nature. The adviser remains responsible for any advice/services they provide to clients using this information, including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

It’s important a person considers their circumstances and reads the relevant product disclosure statement and/or investor directed portfolio services guide and target market determination, available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them. Any general tax information provided is intended as a guide only and is based on our general understanding of taxation laws current at the date of publication. It’s not intended to be a substitute for specialised taxation advice or an assessment of liabilities, obligations or entitlements that arise, or could arise, under taxation law, and we recommend that advice be obtained from a registered tax agent / tax professional before deciding to act on the information provided. Information in this article is subject to change without notice.

The views and opinions of the advisers in this article are theirs and may not represent or depict your experience. It is not a guarantee, promise or reflection of other user’s experiences. The advisers have not been paid to provide their view or opinions on this page.

*Quote from Adam Renouf, Managing Director at Renouf & Partners