In today’s busy world, time is critical. So whether you’re completing a client review, performing a switch or preparing an ROA, you need your platform to work as efficiently as possible to free up your time to add value with your clients.

Did you know you can assign a risk profile to your client account to make sure their investment mix is within risk tolerance ranges…all on the North platform?

So now it’s easy to maintain the right investment mix without fiddling around with external tools.

- Get the most accurate view of your client portfolio to check it’s in line with target allocations.

- Receive an optional quick alert and take action when an allocation deviates from acceptable range.

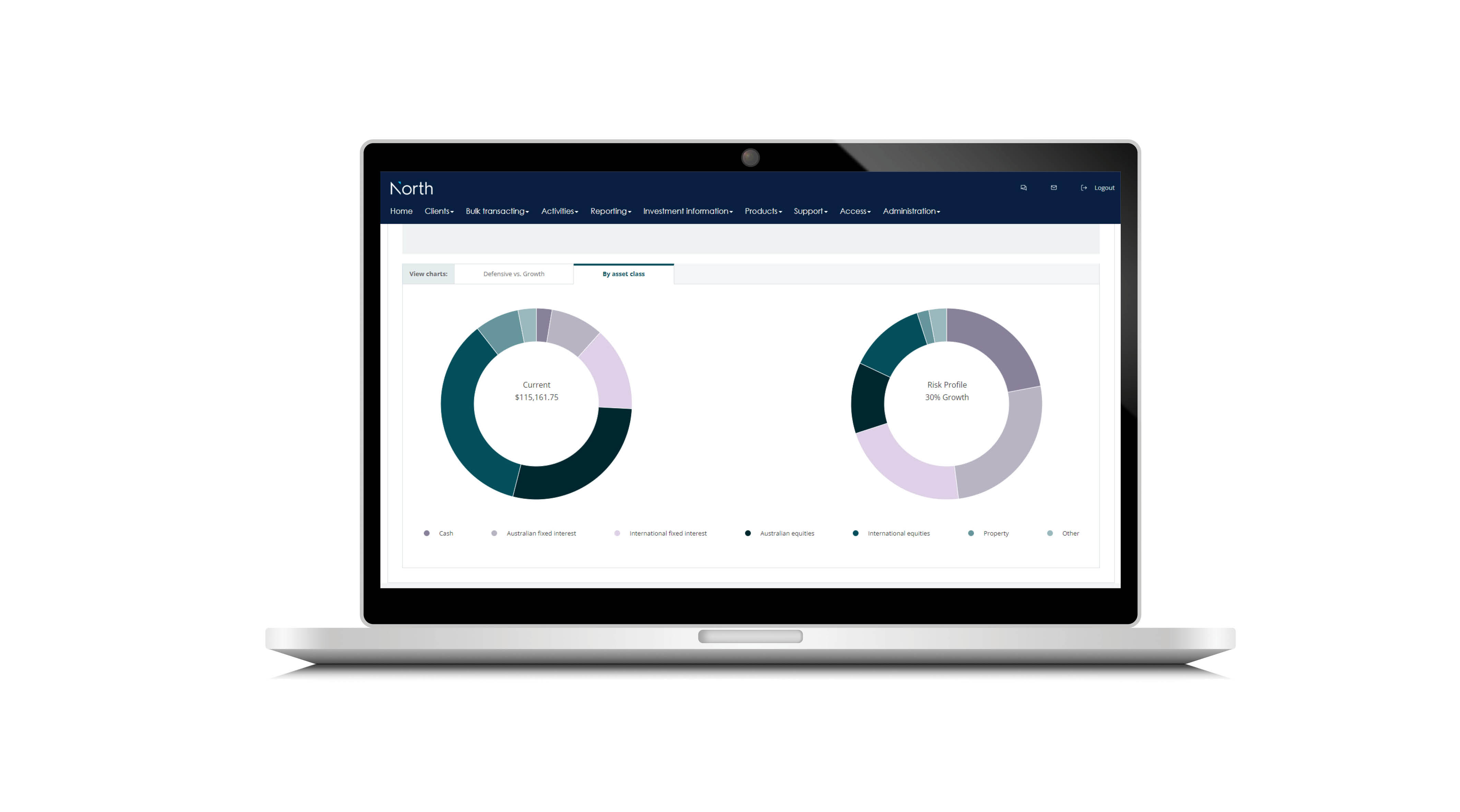

- Help clients better understand risk profiles by using the charts in discussions.

Many advisers are already using risk profiles on North to save time and enhance their client service. So don’t get left behind…start using risk profiles today.

Getting started

If your Licensee has added risk profiles, you'll find them when reviewing your client’s account summary or performing an investment switch.

Otherwise you can easily add them yourself through the quick setup process on North Online.

How it works – hint it’s simple and intuitive

You can easily check in real time the portfolio you’re recommending for your client is within their risk tolerance ranges.

1. ADDING AND UPDATING CLIENT RISK PROFILES

Once you’re all set up, you can easily add or update your client’s risk profile when their circumstances change – either from the Account Summary page or while you’re performing a switch.

2. CHECK AGAINST TARGET

You can see how your client’s investment portfolio aligns to their target allocations. Warning messages will guide you when the asset allocation is outside the acceptable range for the risk profile.

3. GET ALERTS

You can also opt in to event alerts at a frequency of your choice so you can easily take action if there are any variances between your client’s risk profile and their asset allocation.

4. PREPARE ROA

When you’re preparing ROAs, your input document will show the variance between your proposed asset allocation and the risk profile, helping you meet your disclosure requirements.

Looking to start using risk profiles on North? Chat to your BDM today.

Innovative Betashares Geared Managed Portfolio Series added to North platform

28 March 2025 This month we’ve added the Betashares Moderately geared managed portfolios series to our investment menu. Read more

Introducing AZ Sestante to North

28 March 2025 This month we’ve added AZ Sestante and their managed portfolios to our investment menu. Read more

Introducing Innova Asset Management to your client investment solutions

28 March 2025 This month we’ve added Innova Asset management and their managed portfolios to our investment menu. Read more

Important information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your client’s personal objectives, financial situation or needs, and a client should consider whether this information is appropriate for them before making any decisions. It’s important your client consider their circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

MyNorth Investment and North Investment are operated by NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFSL 234652 (NMFM). MyNorth Super and Pension (including MyNorth Lifetime), MyNorth Super and Pension Guarantee and North Super and Pension are issued by N.M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654 (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. NMMT issues the interests in and is the responsible entity for MyNorth Managed Portfolios. All managed portfolios may not be available across all products on the North platform. All of the products above are referred to collectively as MyNorth Products. The information on this page is provided only for the use of advisers, it is not intended for clients. This page provides a brief overview of some of the benefits of investing in MyNorth Products. The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N.M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N.M. Super) and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.