We’ve been continually improving North’s switch capabilities, to provide you with an all-encompassing tool. Powerful scenario modelling, ultimate flexibility and reduced admin burden are a few of the outcomes we’re delivering.

And one of our latest enhancements is providing a better way to reweight client portfolios. Giving you more flexibility, accuracy and overall efficiency.

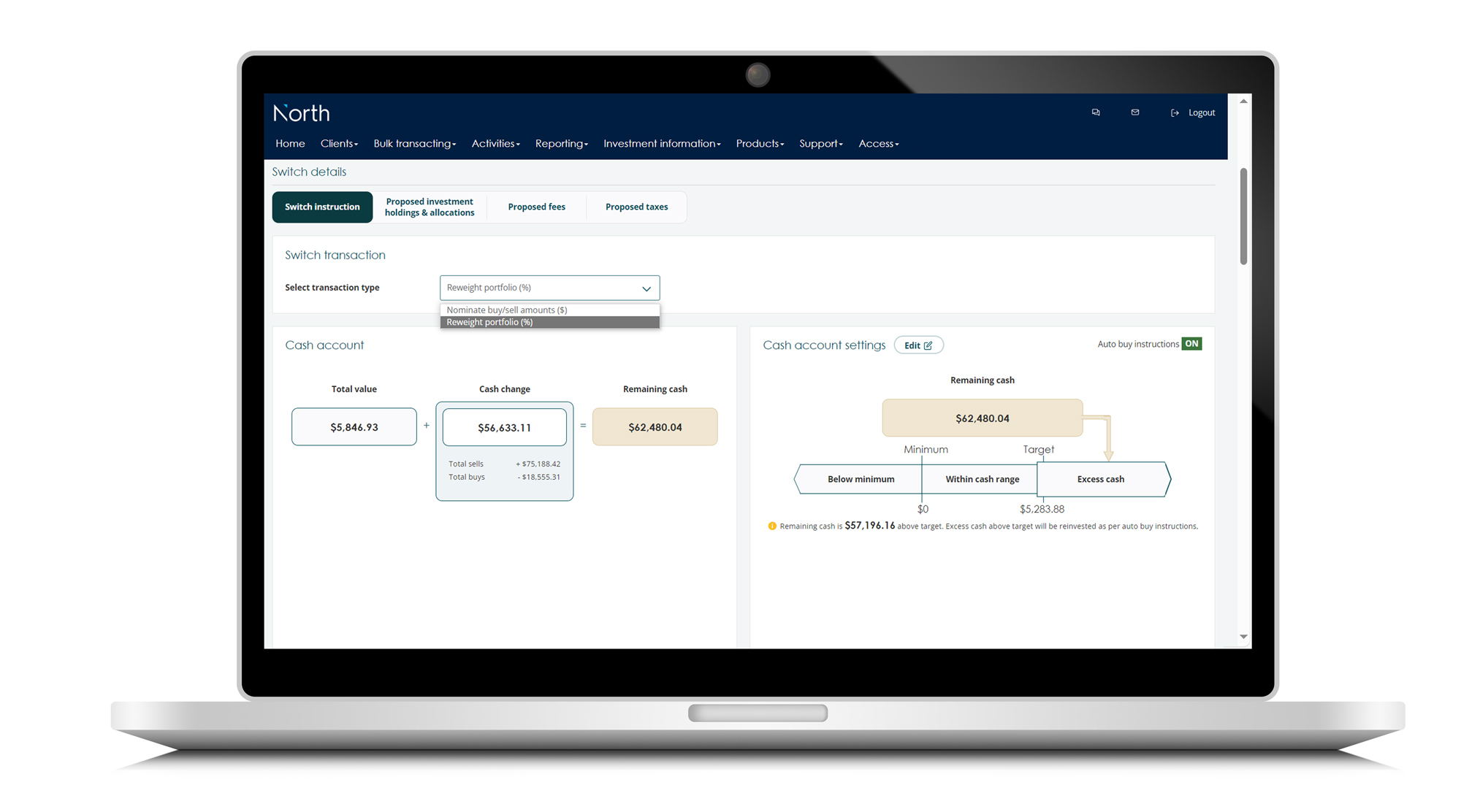

You now have two powerful ways to place your trades:

- Enter target weight: Simply enter target percentages for each investment directly into the intuitive Switch instructions grid. The system will then calculate the necessary trades to achieve your goals.

- Enter buy or sell amount: This option offering direct control over investment size remains unchanged

Both methods seamlessly integrate with your advice documentation, allowing you to effortlessly translate percentage-based recommendations into actionable Switch instructions. No more manual recalculations before entering your trades.

The flexibility doesn't stop there. You can also:

- Tap into Switch's powerful tools: As always, Switch offers a range of powerful features to help you make informed decisions. Model taxes, compare fees, assess asset allocation, and even generate reports like the ROA document – all within the same tool

- Update Cash account targets: Cash account settings can now be updated as part of the first step in Switch instructions. Bringing these settings forward means new Cash targets are now able to be reflected and factored into the Switch instructions.

- Experience greater efficiency with consent forms: If investment instructions are altered as part of a Switch, you'll now only need to complete a single consolidated authorisation form.

And we’ve introduced unprecedented traceability too

Upon submitting a switch transaction you can now view expected completion dates in Activity Management as well as progress and status updates. Manage your clients’ expectations with maximum confidence and precision.

Also, here’s a hot tip

Did you know that you can further enrich asset allocation modelling by adding a Risk profile to Client Accounts on North? This will also feed directly into your RoA.

Learn more about risk profiles on North

With its intuitive new methods, combined with its existing powerful tools and North's Contra-trading functionality, Switch makes trading faster, simpler, and more efficient than ever.

For more information on this enhancement login to North and access the guide available via North Online > Support > Training Resources: How to Guide: Switch investments

Important information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your client’s personal objectives, financial situation or needs, and a client should consider whether this information is appropriate for them before making any decisions. It’s important your client consider their circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

MyNorth Investment and North Investment are operated by NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFSL 234652 (NMFM). MyNorth Super and Pension (including MyNorth Lifetime), MyNorth Super and Pension Guarantee and North Super and Pension are issued by N.M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654 (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. NMMT issues the interests in and is the responsible entity for MyNorth Managed Portfolios. All managed portfolios may not be available across all products on the North platform. All of the products above are referred to collectively as MyNorth Products. The information on this page is provided only for the use of advisers, it is not intended for clients. This page provides a brief overview of some of the benefits of investing in MyNorth Products. The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N.M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N.M. Super) and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.