In today’s busy world, you want to be spending less time on admin and more time servicing your clients.

And your clients expect a flexible experience that lets them get on with their lives.

That’s why we offer digital consent on North so your clients can approve your requests without needing to print or sign any paperwork.

Secure and traceable, it adds up to a smoother experience all round for you and your clients.

- You can use digital consent for advice fees (super and pension) and bank detail changes.

- You can send requests to clients while they’re in your office so they can immediately consent.

- And you’ll get confirmation straightaway – no need to wait for the North Service Centre to validate

Digital consent is super simple for you...

1. START | Select North Online digital consent

2. REVIEW | Download and check documents

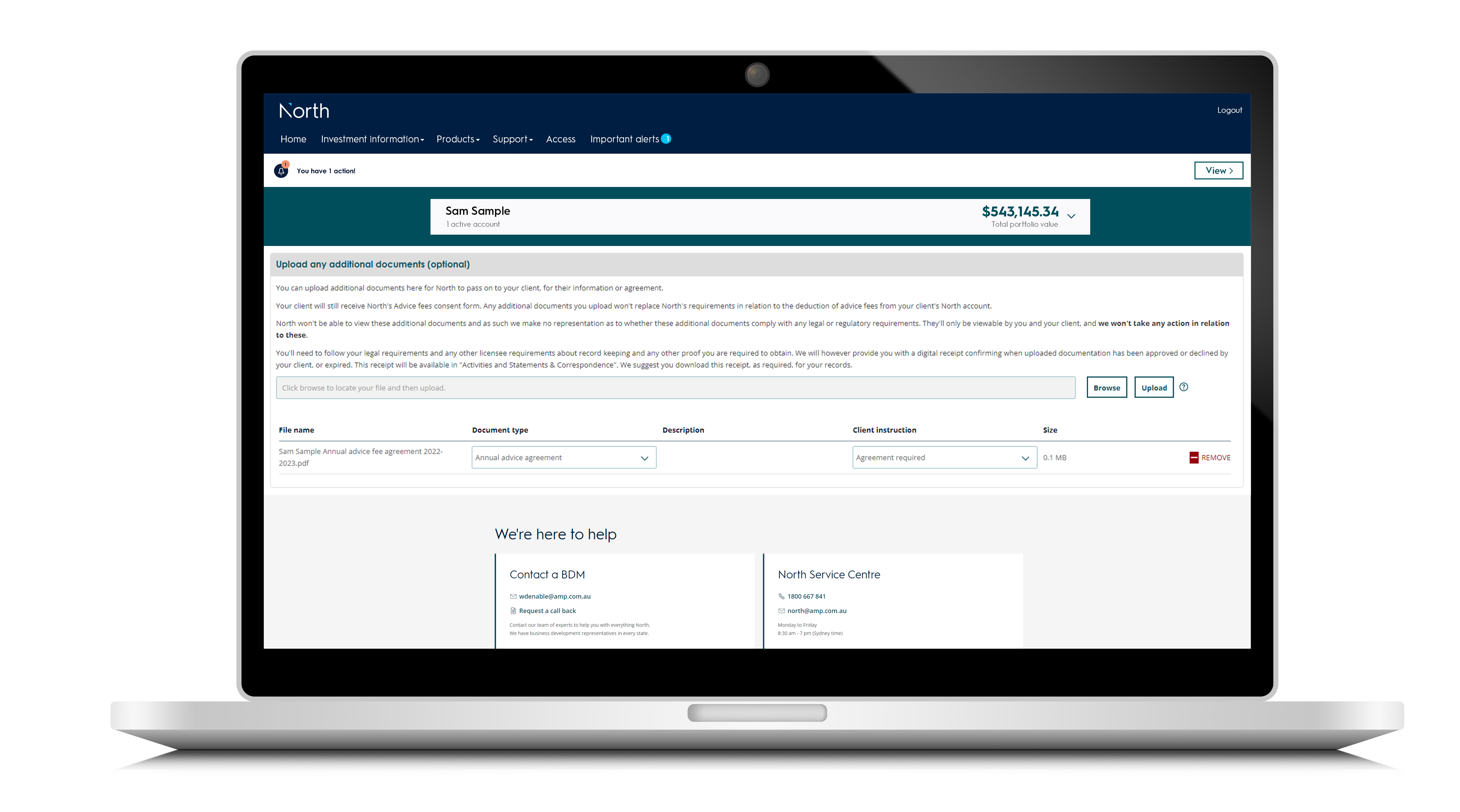

3. UPLOAD | Add extra advice documents with advice fee consent to bundle your consents together

4. NOTIFY | Opt in or out of notification emails

5. CONFIRM | Simply tick the box...

6. SEND | ...and send the email or SMS to your client

7. TRACK | You'll receive a confirmation email once the client has responded and you can view a list of requests.

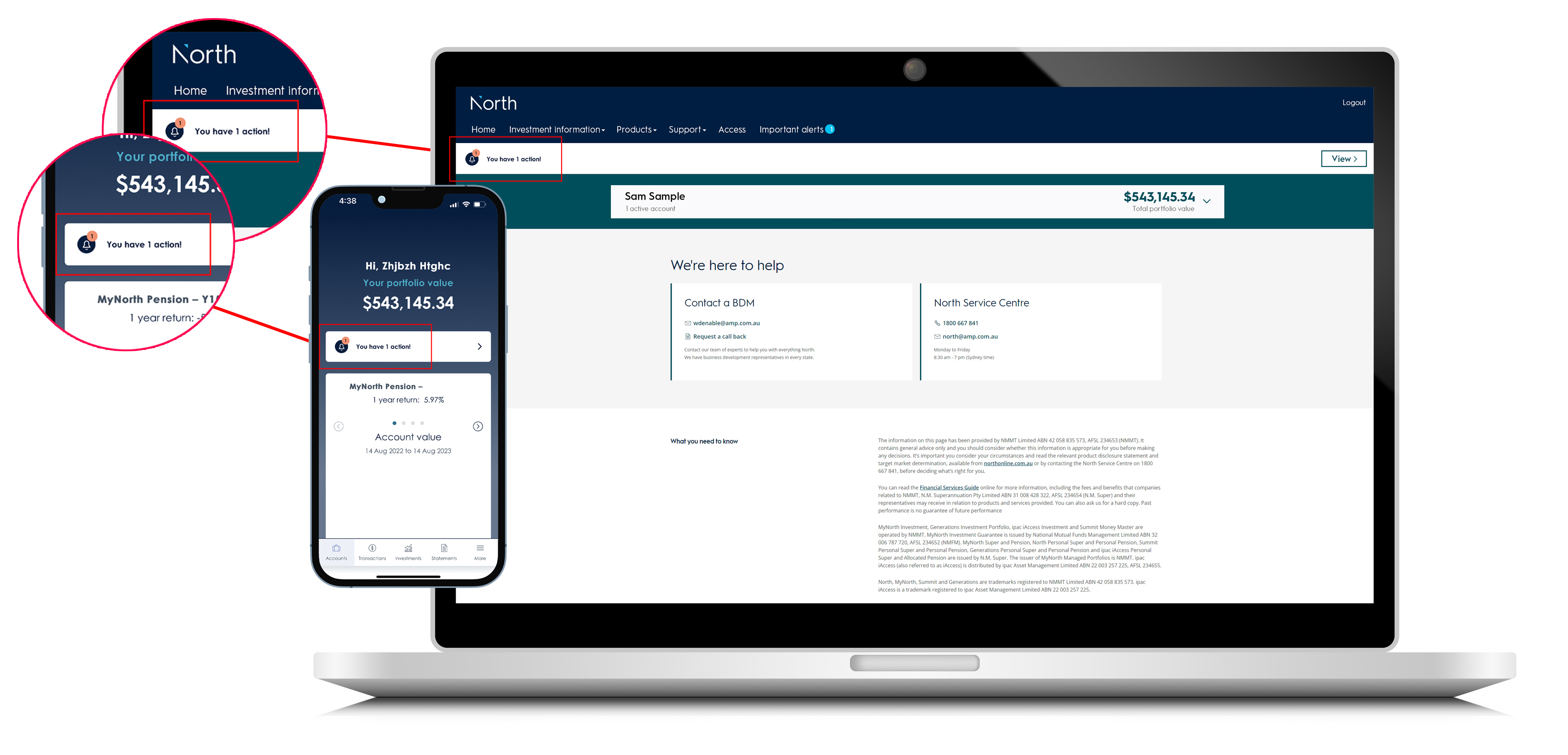

...and your clients

1. VIEW | Your clients can view the request by logging in to North Online, opening the app or clicking on the email link1

2. REVIEW | Your clients can download and read through the documents, and easily get in touch with you if they need to check anything.

3. RESPOND| Your clients can simply click a button to Approve or Decline

3. TRACK| Your clients will receive an immediate confirmation email and they can view a list of requests at any time.

Did you know?

You can bundle other advice documents together with advice fee consent and send to your clients in one go using our document upload feature.

And don't just take our word for it...

"We've benefited greatly from North's digital consent process. It's freed up a lot of resources and helped us enourmously."

Anthony Jury, Financial adviser, Anthony Jury & Associates2

Reach out to your BDM to learn how switching to digital consent can free up your time and amplify your advice.

We’ve also created a simple guide on how to use North digital consent that you can share with your clients.

It’s just another way we’re continuously improving your North experience.

How to stay scam aware this silly season

24 November 2025 Remaining vigilant about data and digital security is particularly important around holiday season as phishing attempts increase. The North team want to share a few reminders for you and your clients on staying safe online. Read more

Activity Management: Your workflow enhanced

05 November 2025 We are committed to supporting you in delivering exceptional service and streamlining your client workflows. That’s why we encourage you to take full advantage of the Activity Management feature available in North Online. Read more

North RoA Enhancements: Faster, Smarter, Simpler

29 October 2025 At North, we’re committed to making your advice process as seamless and efficient as possible. That’s why we’re excited to introduce the latest enhancements to the Record of Advice (RoA) experience on North—designed to save you time, minimise manual work, and help you deliver even greater value to your clients. Read more

Important information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your client’s personal objectives, financial situation or needs, and a client should consider whether this information is appropriate for them before making any decisions. It’s important your client consider their circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

MyNorth Investment and North Investment are operated by NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFSL 234652 (NMFM). MyNorth Super and Pension (including MyNorth Lifetime), MyNorth Super and Pension Guarantee and North Super and Pension are issued by N.M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654 (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. NMMT issues the interests in and is the responsible entity for MyNorth Managed Portfolios. All managed portfolios may not be available across all products on the North platform. All of the products above are referred to collectively as MyNorth Products. The information on this page is provided only for the use of advisers, it is not intended for clients. This page provides a brief overview of some of the benefits of investing in MyNorth Products. The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N.M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N.M. Super) and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.

1 All of these options are available for clients where North has a validated mobile and email address. If North has an email only, the client will not have the option to use an email link as this requires an SMS verification.

2 Anthony is an Authorised Representative (285732) of MASU Financial Management (AFSL 231140).